Atal Pension Yojana

The Government of India is concerned about the old age

income security of the working poor and is focused on

encouraging and enabling them to save for their retirement.

To address the longevity risks among the workers in

unorganized sector and to encourage the workers in

unorganized sector to voluntarily save for their retirement.

The GoI has therefore announced a new scheme called Atal Pension Yojana (APY)1 in 2015-16 budget. The APY is focussed on all citizens in the unorganized sector.

The scheme is administered by the Pension Fund Regulatory and Development Authority (PFRDA) through NPS architecture.

Eligibility Criteria

- APY is applicable to all citizen of India aged between

18-40 years. - Aadhaar will be the primary KYC. Aadhar and mobile

number are recommended to be obtained from

subscribers for the ease of operation of the scheme. If

not available at the time of registration, Aadhar details

may also be submitted later stage.

Benefits

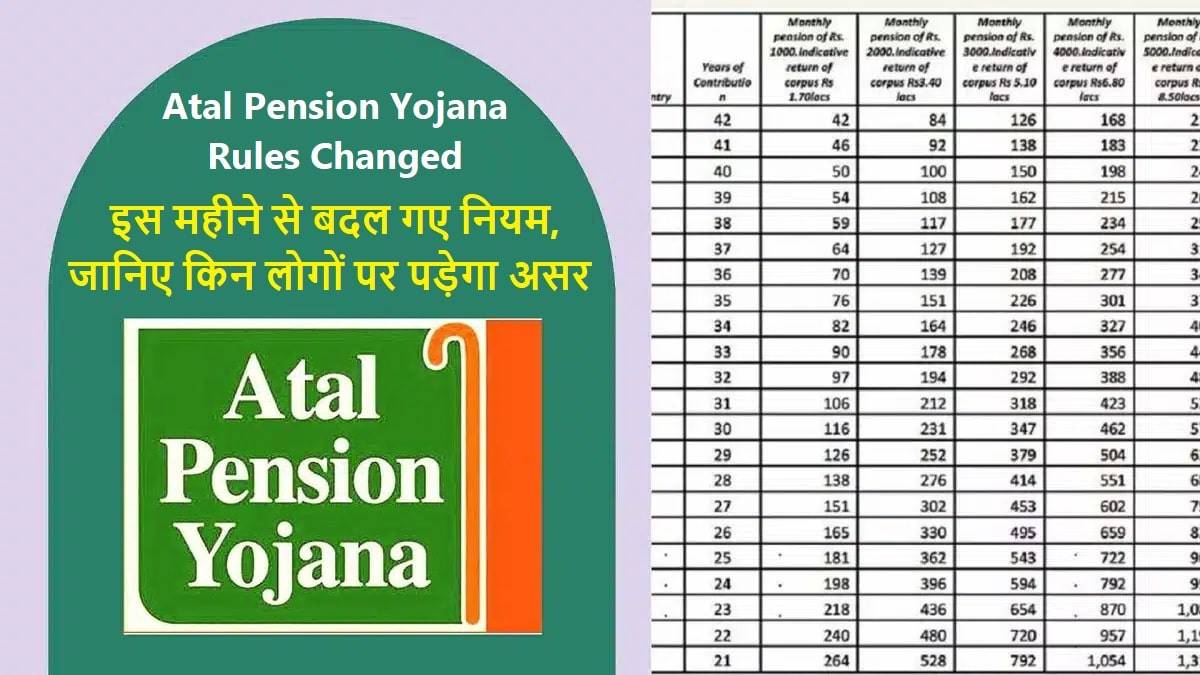

- The contributor on his choice, can attain a pension of 1000-5000 rupees, or he can also get an accumulated sum of the pension after his death.

- The accumulated amount will be given to the spouse or if the spouse is dead as well then to the nominee.

- Guaranteed pension:The benefit of minimum pension would be guaranteed by the GoI

- pension Range: Guaranteed monthly pension of Rs 1000 to 5000 to the subscriber

- Govt. co-contribution: GOI will co-contribute for a aperiod of 5 years who joined the scheme in the period June 01, 2015 to March 31, 2016

How to Apply

- Atal Pension Yojana : Download the Application form https://www.npscra.nsdl.co.in/nsdl-forms.php

- On attaining the age of 60 years:

The exit from APY is permitted at the age with 100%

annuitisation of pension wealth. On exit, pension would be

available to the subscriber. - In case of death of the Subscriber due to any cause:

In case of death of subscriber pension would be available to the

spouse and on the death of both of them (subscriber and spouse),

the pension corpus would be returned to his nominee. - Exit Before the age of 60 Years:

Exit before 60 years of age is not permitted however it is

permitted only in exceptional circumstances, i.e., in the event of

the death of beneficiary or terminal disease.