Credit Guarantee Scheme

Objective of CGTMSE: Availability of bank credit without the hassles of collaterals / third party guarantees would be a major source of support to the first generation entrepreneurs to realise their dream of setting up a unit of their own Micro and Small Enterprise (MSE). Keeping this objective in view, Ministry of Micro, Small & Medium Enterprises (MSME), Government of India launched Credit Guarantee Scheme (CGS) so as to strengthen credit delivery system and facilitate flow of credit to the MSE sector. To operationalise the scheme, Government of India and SIDBI set up the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE).

Credit Guarantee refers to a situation where the loan to the applicant is backed by a party without the need for any external collateral or third-party guarantee. Here, the loan sanctioned by the member lending institution is backed by the scheme which provides the guarantee cover for a large portion of the loan amount. Under the CGTMSE scheme, both new and existing micro and small enterprises, including manufacturing and service enterprises are eligible for a credit facility of up to Rs. 5 crores.

The objective of the CGTMSE is to enable the banks to look at small and micro businesses with objectivity and give more importance to project viability and business model validation. To cover the loan under the credit guarantee fund scheme, the borrower has to pay an additional guarantee fee and service charge in addition to the interest charged by the bank. The current CGTMSE fee is payable at the rate of 1.5%. It is payable at 0.75% for the North-Eastern region including the state of Sikkim.

Eligibility Criteria

- All Existing and New Micro and Small Enterprises (MSEs)

- Manufacturing and Services including Retail trade is allowed

- Educational and Training institutions, Self Help Groups (SHGs), and agriculture-related activities are not eligible

Guarantee Coverage: From 75 to 85% (50% coverage for Retail activity)

Eligible Member Lending Institutions : More than 100 PSU, NBFC’s , RRB’s , Private Banks, SUCB’s, FI’s etc

Small and Micro-Enterprises owned and/or operated by Women Entrepreneurs are eligible for a Guarantee Cover of 80%, whereas all the credit/loans in the North East Region (NER) for credit facilities are eligible for a guarantee of Rs. 50 lakh.

Note: Educational institutions, agriculture, training institutions, and Self-Help Groups (SHGs) are not eligible for guarantee cover under CGTMSE. The CGTMSE loan limit solely depends on the applicant’s profile and business requirements.

Benefits

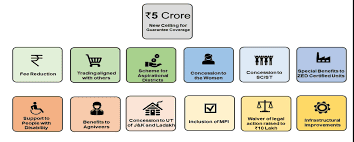

- Ceiling for Guarantee coverage raised from Rs. 200 lakh to Rs. 500 lakh

- Guarantee fee reduced to diminish the overall cost of borrowings to MSEs

- Micro Finance Institutions as Member Lending Institutions (MLIs) are now eligible

- Concessions related to fees and increased coverage to SC/STs

- Reduced Guarantee fee by 10% and coverage extent increased to 85% to Women, ZED Certified Units and Units in Aspirational Districts

- Annual Guarantee Fee structure revised and fee reduced to as low as 0.37%

How to Apply

- Lending Institutions Offering Funds against CGTSME Scheme:

- Scheduled Commercial Banks (SCBs)

- Regional Rural Banks (RRBs)

- Small Finance Banks (SFBs)

- Non-banking Financial Companies (NBFCs)

- Small Industrial Development Bank of India (SIDBI)

- National Small Industries Corporation (NSIC)

- North Eastern Development Finance Corporation Ltd. (NEDFi)

- The procedure for applying and availing loans under CGTMSE is as follows:

Step 1. Formation of the Business Entity

Step 2. Preparing a Business Report

Step 3. Sanctioning of Loan from the Bank

Step 4. Obtaining the Guarantee Cover.